Top 5 2018 Megadeals Review and Early 2019 Deals

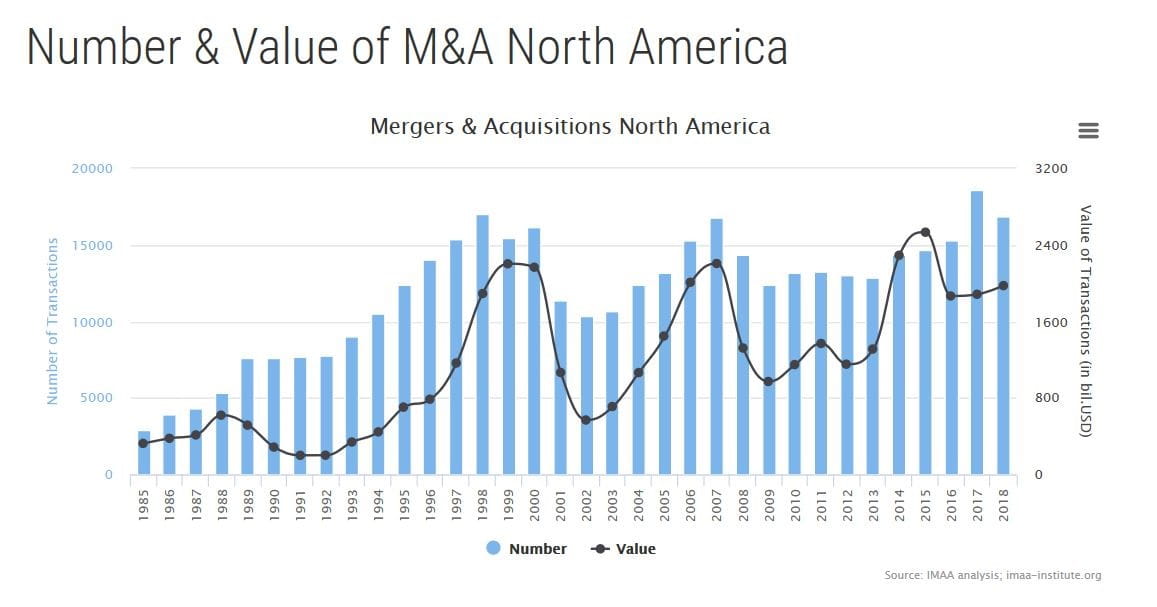

2018 was a big year for Mergers & Acquisitions. Domestic M&A value reached $1.5 trillion, marking the second-highest total deal value for U.S. companies in recorded history after the $1.98 trillion set in 2015, according to Mergermarket. Deal counts for the year were also impressive, with 5,718 transactions falling just under the all-time record of 5,800 deals in 2017. Despite uncertainties across U.S. legal, social and economic landscapes, a surge in “megadeals”–those valued over $10 billion–assisted in driving the growth that bolstered these upward trends in 2018.

“With so many market-moving factors fluctuating throughout the year, mergers and acquisitions have understandably had a somewhat ambivalent 2018. Intensifying trade tensions, political instability, and increased regulatory scrutiny took their toll on the number of deals struck over the year, though deal values remained relatively high.”

The top 5 megadeals took place among the telecommunications, power and utilities, healthcare and technology sectors. The highest-value megadeal, between Cigna Corporation and Express Scripts Holding Company, closed on December 20, 2018. Following in the previous month’s wake of CVS Health’s completed acquisition of Aetna, vertically-integrated megadeals like these are redefining healthcare provider roles and could lay the groundwork to disrupt market dynamics entirely. This new framework provides companies opportunities for remarkable scale and scope.

Top 5 Megadeals in 2018

| Buyer | Target Company | Value (USD $B) | Industry |

|---|---|---|---|

| Cigna Corporation | Express Scripts Holding Company | $67.6 B | Healthcare |

| T-Mobile US, Inc. | SoftBank Group Corporation (Sprint Corporation) | $59.6 B | Telecoms |

| Energy Transfer Equity LP | Energy Transfer Partners LP | $60.8 B | Energy, Mining, Utilities |

| IBM Corporation | Red Hat, Inc. | $32.6 B | Technology |

| Marathon Petroleum Corporation | Andeavor Corporation | $31.3 B | Industrials & Chemicals |

Full Steam Ahead in 2019

The new year has already seen several megadeals announced in the pharmaceuticals, banking, mining, fintech, and biotech sectors.

On January 2, 2019, the pharmaceutical company Bristol-Myers Squibb agreed to acquire the biotechnology giant, Celgene Corporation, in a $74 billion deal. This resulted in the largest healthcare deal ever made and is the 6th largest North American M&A transaction in recorded history. BB&T and SunTrust announced their $66 billion merger in early February of this year, forming the sixth-largest U.S. bank holding company. This is the first megadeal between banks in a decade and is expected to close in the fourth quarter of 2019.

2019 YTD Megadeal Announcements

| Buyer | Target Company | Value (USD $B) | Industry |

|---|---|---|---|

| Bristol-Myers Squibb | Celgene Corporation | $74 B | Pharmaceuticals |

| BB&T | SunTrust | $66 B | Banking |

| Newmont Mining | Goldcorp | $10 B | Mining |

| Fiserv | First Data | $22 B | Fintech |

2019 Deal Influences in 2019

According to Deloitte’s annual survey, The state of the deal: M&A trends 2019, the most important aspects of corporate M&A strategy are to expand/diversify products or services and broaden the customer base in existing geographic markets.

“The number of corporate and private equity respondents that anticipate the current level of M&A activity to continue or even grow in 2019 is quite large—almost 90 percent.”

There are certain market factors that were especially favorable to domestic M&A dealmakers in 2018: the 2017 tax reforms, affordable financing, a strong stock market and investor support. Combined with a high level of confidence from M&A executives, it appears reasonable that these factors will continue to facilitate M&A growth throughout 2019.

It’s not all easy sailing from here: M&A acquirers and target companies face a wide array of challenges, from stock market volatility and economic and geopolitical uncertainty to emerging technologies, and the potential impact of tariffs or other legislative and administrative activity could all curb deal activity this year.

Certain developments in privacy legislation–such as Europe’s GDPR or California’s recent Consumer Privacy Act–also create an elevated risk for M&A activity and increase the need for comprehensive due diligence.

Challenges outside of financial or regulatory contexts also need to be considered. Vetting acquisition targets must include increased attention to current and past harassment and discrimination incidents. Cyber attacks that target businesses have never been more sophisticated or frequent. Failure to identify these risks can lead to irreparable financial and reputational harm if concerns are raised after the transaction has been closed.

Additional Risk Factors:

- Consumer demographic shifts

- Regulatory uncertainties

- Rising interest rates

- Geopolitical concerns

- Capital market volatility

- Trade tensions

- Government shutdowns

When investments do not generate their expected return, corporate and private equity executives place the most blame on these external factors. But in order to meet revenue expectations, it is as important to integrate a more effective due diligence process into your company’s existing M&A strategy.

Pre-Transaction Due Diligence

Companies focused on, and driven to complete, mergers and acquisitions should incorporate pre-transaction due diligence into their decision-making process, so they can mitigate risks and enable their entry into favorable deals.

As stakes and values rise, the inclusion of human analysis into the due diligence process becomes even more imperative. Prescient’s Pre-Transaction Due Diligence service helps private equity firms, investment banks, and corporate development teams uncover previously-unknown risks ahead of a deal’s closing. Using this new intelligence, decision makers can make informed choices about the future of a deal, and whether to alter their stance during negotiations. Due diligence does not present an obstacle to the completion of a deal, but rather equips executives with the knowledge needed to ensure that their organization stays safe and profitable during a time when mergers & acquisitions are more prevalent, and thus riskier, than ever before.

Use Cases:

- Mergers & Acquisitions

- Joint Ventures

- Initial Public Offering (IPO)

- Strategic Investments

- Market Entry

Service Highlights:

- Open Web Reputational Reviews

- Media Review

- Social Media Reviews

- Business and Professional History Review

- Legal and Regulatory Records Research

Resources:

- https://imaa-institute.org/mergers-and-acquisitions-statistics/

- https://www.prescient.com/blog/case-study-corporate-due-diligence/

- https://www.prescient.com/practices/due-diligence/pre-transaction-due-diligence/

- https://www.pwc.com/us/en/services/deals/year-end-review-and-2019-outlook.html

- https://www.pwc.com/us/en/services/deals/industry-insights.html

- https://www.usatoday.com/story/money/business/2018/12/10/mergers-and-acquisitions-2018-10-biggest-corporate-consolidations/38666639/

- https://www.allbusiness.com/data-privacy-cybersecurity-issues-mergers-and-acquisitions-due-diligence-checklist-119265-1.html

- https://www.ft.com/content/b7e67ba4-c28f-11e8-95b1-d36dfef1b89ahttps://www.pwc.com/us/en/services/deals/industry-insights.html?WT.mc_id=CT11-PL1000-DM2-TR1-LS4-ND30-TTA9-CN_DHDealsCFO-DH&eq=CT11-PL1000-DM2-CN_DHDealsCFO-DH

- https://pitchbook.com/news/reports?

- https://www.cnbc.com/2019/01/14/newmont-to-buy-goldcorp-in-a-10-billion-all-stock-deal.html

- https://www.mergermarket.com/info/info/mergermarket-releases-2018-global-ma-report

- https://www.forbes.com/sites/suntrust/2018/12/06/the-5-biggest-trends-in-mergers–acquisitions-for-2019/#d0a960e1ca14